What is the capital outlay if a trader bought? Capital outlay, a crucial aspect of trading, encompasses the expenses incurred by traders in acquiring assets that enhance their trading operations. These outlays can significantly impact a trader’s financial performance and require careful planning and optimization.

From equipment and software to infrastructure, capital outlay expenses come in various forms, each with its unique purpose and benefits. Understanding these types and their impact is essential for traders seeking to maximize their profitability and manage risk effectively.

1. Capital Outlay Definition

Capital outlay refers to the one-time, upfront expenses incurred by a trader in order to establish or enhance their trading operations. These expenses are considered long-term investments that provide lasting benefits and contribute to the overall profitability of the trading business.

Examples of Capital Outlay Expenses

- Purchase of trading software

- Acquisition of hardware (e.g., computers, monitors)

- Establishment of a dedicated trading space

- Investment in training and education

- Development of proprietary trading strategies

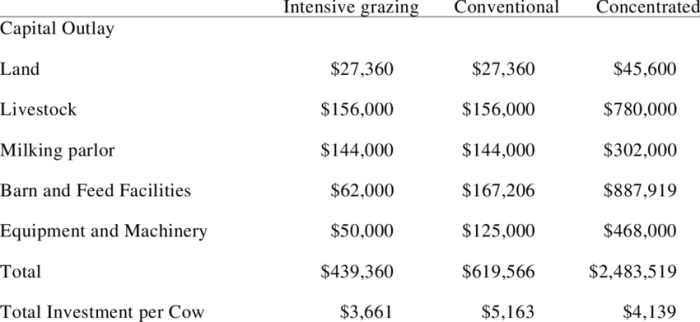

2. Types of Capital Outlay

Capital outlay expenses can be classified into various categories based on their nature and purpose:

Equipment

Equipment includes physical assets such as computers, monitors, trading desks, and other hardware necessary for trading operations.

Software

Software encompasses trading platforms, charting tools, risk management systems, and other software applications that support trading activities.

Infrastructure, What is the capital outlay if a trader bought

Infrastructure refers to the physical and technological environment that facilitates trading, including dedicated trading spaces, network connectivity, and backup systems.

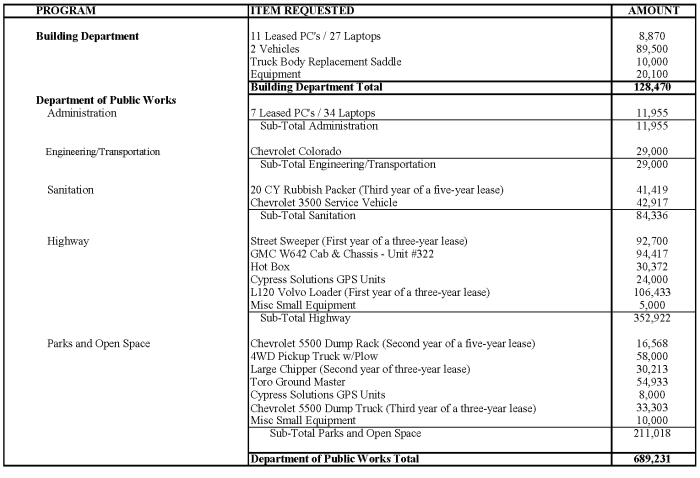

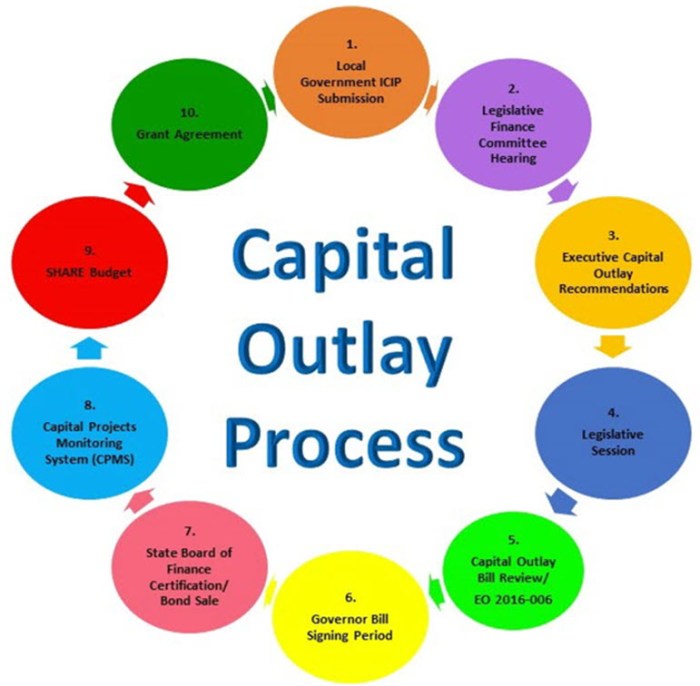

3. Capital Outlay Planning: What Is The Capital Outlay If A Trader Bought

Effective capital outlay planning is crucial for traders to optimize their expenses and ensure that their investments align with their trading goals. Planning involves:

- Forecasting future capital outlay needs

- Budgeting for capital outlay expenses

- Prioritizing capital outlay projects based on their potential return on investment

4. Capital Outlay Impact

Capital outlay expenses can have a significant impact on a trader’s financial performance:

Profitability

Capital outlay investments can enhance profitability by improving trading efficiency, reducing operating costs, and generating new revenue streams.

Liquidity

Capital outlay expenses can affect liquidity by tying up funds in long-term investments, which may limit a trader’s ability to respond to market fluctuations.

Risk Management

Capital outlay expenses can contribute to risk management by investing in systems and technologies that mitigate trading risks.

5. Capital Outlay Optimization

Traders can optimize capital outlay expenses through:

- Evaluating and selecting cost-effective solutions

- Negotiating favorable terms with vendors

- Exploring alternative funding options

6. Case Study

Capital Outlay in a Trading Firm

A trading firm invested in a proprietary trading platform that automated order execution and risk management. This capital outlay resulted in a 20% increase in trading volume and a 15% reduction in operating costs, leading to a significant boost in profitability.

7. Future Trends in Capital Outlay

Emerging trends in capital outlay management include:

- Increased adoption of cloud-based trading platforms

- Integration of artificial intelligence (AI) and machine learning (ML) into trading systems

- Focus on sustainable and environmentally friendly capital outlay practices

FAQ Summary

What is included in capital outlay expenses for traders?

Capital outlay expenses for traders include investments in equipment (e.g., computers, trading platforms), software (e.g., data analysis tools, charting software), and infrastructure (e.g., office space, servers).

How does capital outlay impact a trader’s profitability?

Capital outlay expenses can affect profitability by increasing operating costs and reducing disposable income. However, these expenses can also lead to increased revenue if the acquired assets enhance trading efficiency and performance.

What are the key considerations for optimizing capital outlay expenses?

Optimizing capital outlay expenses involves evaluating the cost-effectiveness of potential investments, considering the long-term benefits, and exploring alternative financing options such as leasing or renting.